As Malone points out:

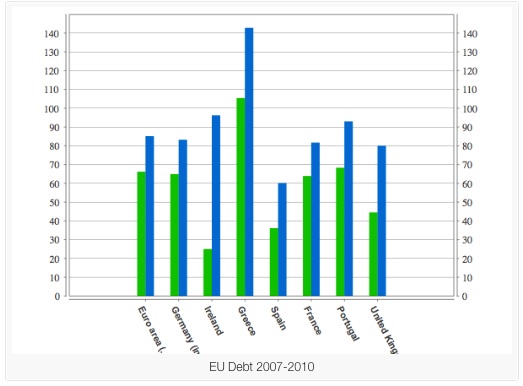

The green bars are debt as percentage of GDP before the bank bail outs and the blue bars are after. .... Notice Ireland. Its debt to GDP was down at 27%. The ONLY thing that altered between 2007 and 2010 was the bank bails outs. Ireland’s ENTIRE debt problem is due to bailing out private banks and their bond holders. ... the fact is that all European nations apart from Portugal were either reducing their debt-to-GDP level or at least not allowing it to grow. Most of Europe was reducing government debt to quite manageable and historically low levels. ...Almost every European country was keeping debt to GDP even or going down – before the banks were bailed out that is. The exceptions, of course, were Greece and Italy ..

The sudden explosion of European sovereign debt is the direct and indisputable result of all our political parties deciding they would safeguard their mates’ and their own personal wealth (it is the top 10% who hold the bulk of their wealth in the financial products which would be destroyed in a bank collapse. NOT the rest of us!) by bailing out the private banks and piling their unpaid debts on to the public purse.

No comments:

Post a Comment

Comments will be lightly moderated, with disfavor for personal attacks and stunning irrelevancies, and deference to the trenchant and amusing.